The Business Case for Whole System Thinking -

The Genesis of GRI Equity

Drafted 2002

Background * Market Opportunity* Keys to Success

Business Background

Thirty years ago public awareness of the challenges of balancing progress with responsibility reached a new level. The 1960s saw the emergence of a market for sustainable products and services. Research and commercial development since then presents us today with a broad selection of sustainable substitutes across lifestyles, and the fastest growing consumption segment.

We began to focus on the challenge of resolving multiple, often seemingly incompatible, objectives in the late 1990s, during the Asian Crisis. When currencies, like the Thai Baht in 1996, rapidly devalued the consequences of rapid growth without paying attention to quality were compounded in a short amount of time. Managing venture capital portfolios in that environment created a rare learning opportunity which we have been able to build upon.

Today similar characteristics to that Asian Currency Crisis seem evident:

-

There are significant assets at risk and financial imbalances gloablly.

-

Private and public investors have been rocked by "Enron risk". We are faced with the new world order, or as some might call it, new market dynamics. We are pressed by increasing demands in ethics, governance, environment, finance, people management and customer service. Technology cycles are shorter than product lifecycles.

-

On top of this, we are concerned by unreasonable gaps in diligence and ethics by those in positions of power. Individuals and institutions have not exercised the responsibility that their position of power demands. Such as fund managers failing to deliver finduciary responsibility.

Today, in this increasingly volatile world, driven by an increasing and unfulfilled global demand for fulfilling substitutes, there are equally sophisticated technologies that can deliver solutions. We can satisfy all stakeholder objectives, whether financial, human, ethical, or environmental. Our holonic approach is not difficult to understand, though it is complex because it accommodates many variables, both quantitative and qualitative. GRI Equity is the vehicle used to allow global private and institutional investors and businesses to share in our management infrastructure and technology.

Investors and businesses are now looking for the solution to balancing ethics and economics. Sustainable business practice is the proven solution. In the world of finance, whether The World Bank and UN or global fiduciaries like Societe Generale, Dexia, Barclays, ISIS (Ivory & Sime) and others, players are moving to sustainable economics to develop long lasting success. Those that can embed family values are likely to last generations.

Those that invest in this technology first will benefit. The understanding of how to manage sustainably, whether it be financial assets or people or goodwill, is easily accessible through web based research and other reading. It is leading edge and demanded by main stream players. We enjoy helping clients move along the learning curve quickly to realise sustainable success.

Early 1990s

The plans for GRI Equity were laid in the early 1990s when Tom started to focus on the challenge of balancing economic success with high ethical standards. At that time, rapid technological and social change, like the introduction of the world wide web, the fall of the Berlin Wall, the Tiananmen Square marches, LA riots, ozone layer concerns, tobacco regulation and so on, was signaling the advent of new global consumption patterns. Institutional interest was not yet prepared to entertain the idea that consumers would prefer sustainable alternatives to goods and services. Consumer markets were not yet aware of alternatives and businesses were unwilling to take the risk that consumers (industrial or retail) valued sustainability, in whatever sphere it may be built.

Market Opportunity Available Now

Today, all forces are pointing in the same direction: growth of sustainable substitutes in all sectors. Institutional interest in sustainable solutions is being driven by consumer markets. Economic performance of sustainable businesses can now be demonstrated across primary, secondary and tertiary sectors, including food, clothing, energy, transport, entertainment, materials, leisure, banking and asset management. And the markets for sustainable alternatives are generally growing faster as substitution accelerates. The most striking illustration of individual consumers changing global behaviour is the call for a peaceful solution in Iraq made by millions from all walks of life around the world in early 2003. Calls for peace have encouraged global superpowers to act more as united nations and delay military intervention in Iraq.

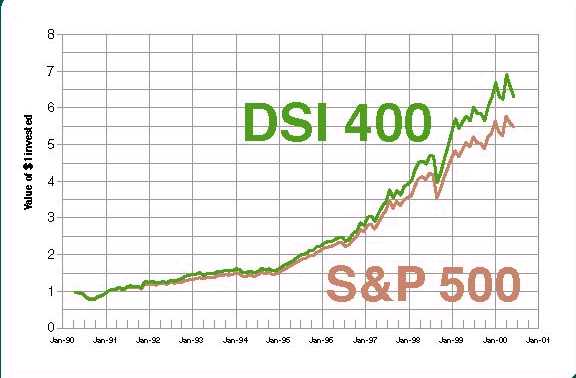

From 1999, our secondary research clarified the attractiveness of this market opportunity: to focus resources on developing sustainable businesses because of compelling evidence that they offer better risk return profiles. In addition, experiential research in building and running sustainable businesses have provided us with a clear understanding of sustainable business dynamics and consumer profiles. A wealth of research (some accessible through GRI Equity's website) and industrial operating experience in primary (farming), secondary (food) and tertiary sectors (catering, education, training and portfolio management) provide the competitive advantages which GRI Equity offers partners and clients.

2002 - Sentiment Change in The Market

The plans for GRI Equity were laid by 2001 and circulated among eight advisors. The conclusion drawn was that timing was not appropriate: institutional markets were focussed on managing the unfamiliar deflation of the asset bubble. But by late 2002 the sentiment had changed. Today, many businesses realise that economic success, even survival, can only be sustained by building authentic businesses. This is not difficult to do and appears to be common sense. However, while the know-how is easily available, the challenge of combining qualitative variables, like governance, environment and stakeholders' interests, with financial analysis is unfamiliar. The great challenge is to realise that the business performance is now benchmarked against best-practice in many areas, not minimum acceptable practice with most short-term profit. Historical practices make it difficult to reach honest compromises internally, but businesses that have identified the challenge at the highest levels are poised for sustainable success.

Whether your business is driven to higher standards by an innate desire or understanding of global commerce or driven by new trends in governance, financial markets, consumer demands and technology, everyone - businesses, consumers and governments - are demanding new solutions. Successful businesses require a broad-based understanding of technology (business, information, industrial, natural) and the profile of the new consumer (individual and institutional). This broad perspective is not yet widely available.

Across the globe and across industries the same challenges are faced, but rarely understood. GRI Equity balances ethical and economic objectives. Our perspective allows us to resolve these challenges. Integrating the disciplines of financial analysis and venture capital management with global perspective and wide information gathering help us understand business dynamics and quantify strategic and financial risk/return profiles.

Through GRI Equity's website, you can find links to much of the technology and consumer data used for screening opportunities, evaluating economics and markets or background research. Please browse freely and use the information at your discretion. Please contact us if you would like further information or would like to engage our services.

The Market Is The Opportunity

It used to be accepted economic/political wisdom that the strongest/biggest individual sat on the top of the pile. Today, even the largest businesses and countries realise that those last vestiges of the command economy model are being wiped away by technology that allows individuals to influence markets in everything from food to current events. Individuals around the world are changing the world as they, or we, decide what to spend money on – the global market system is increasingly efficient at pricing human economics. Economic dynamics are driven by millions of individuals in the market rather than a command mechanism - as Charles Handy describes the business landscape: fleas are becoming more dominant than elephants. Individuals are quietly, but surely and quickly, moving markets.

Individuals make a difference. Individuals that share their technology, like Linux and other freeware/ shareware/ donationware, or data, like UNEP, DJSI or weather.com, or techniques, like fool.com or damordaran online or perspectives, like economist.com or billparish.com. Individuals like those that: uncovered scandals at Enron, WorldCom, the FBI (and were not themselves covered-up!). Even great companies, like GE, Citicapital and Microsoft, have been touched, which is to be expected in fairness. Individuals like the many that are voicing their concerns over military action in Iraq and thus have persuaded “the powers that be” to act with far more caution, discretion and collusion than their rhetoric foretold at the beginning of 2003. Individuals that vote for organic food with their household spending (such that organic food seems to be taking over middle market supermarkets). Individuals that invest in alternative energy businesses, even unprofitable ones. There are many more examples of consumers influencing the industrial landscape to be seen in front of us daily in the news or at work or play.

The signs of these geopolitical and economic trends are visible to all, though obscured by preconceptions and traditions. Fund managers are being squeezed by increasing demands from customers and regulators in areas of governance, ethics, people management and executive compensation, environment, product life cycles as well as financial demands. Two of the largest energy companies, BP and Shell, have shifted their whole marketing message to environmental consideration. Shell says "Sustainable Development: There is no alternative". And we imagine much of their R&D is on alternative energy.

So let us take our pointers from the giants. From multilaterals like UN (UNEP, GEO 3 etc) and the World Bank to banks like Societe Generale and IMF to energy megaliths like Shell and BP to markets like DJSI and FTSE4Good to giant people like Mikhail Gorbachev (Green Peace International, World Charter, Nobel Peace Laureate) and stars endorsing peace, everyone seems to face in the same direction. Science and technology support the impetus. The naysayers have said their piece since the oil shock of 1972-4 and are now persuaded: Sustainable Development - There Is No Alternative! Rapid growth of markets serving the demand for globally responsible goods and services will be sustained.

Building Sustainable Economic Success

Two keys underpin success to building sustainable businesses: the technology and the customer. One key to building sustainable business is to use accessible and low cost technology to leverage intangible assets, especially people. For example, GRI Equity leverages distributed knowledge resources (smart people!) through a low cost web-based IT system. Proven business management techniques are standardised and made accessible to all. For example, GRI Equity might use data drawn from the web, used in an internal analysis and review process that is shared by the lead manager with other managers and partners to recognise business opportunities and risks, develop objectives and plans, and implement change successfully, more quickly and for lower cost than traditional organisations.

The other key to building sustainable businesses is to respond to the principal customer profile, which is similar across sectors: young at heart, educated, noospherical (globally conscious) and ready for change. Products and services, whether for high or low end consumers, must offer value for money, disclosure of relevant information, appropriate care in their operations and governance.

Much of the research and technology used is accessible through this website. Please browse at your leisure - five minutes of browsing offers ideas and links enough for a beginners guide or to develop advanced concepts in finance and business. In particular, investment industry information is available.

Home * About * Resources * Investors * Businesses * Members * Admin