Cover

Notice

Directory

Definitions

Glossary

Slide Show

Executive Summary:

-Overview

-Administration

-Success Factors

Market Opportunity

Change Technology

Market Dynamics

Timing

Administration

Structure

Strategy

Subscriptions

Administration

Economics

Operations

Business

model

Overview

Infrastructure

Culture

Economics

People

Investment

Process

Overview

Dealflow

Initial screen

Target research

Verification & documentation

Monitor & advice

Exit

Listed investments

Decision making process

Appendicies

Business Model

*Example

Deal Flow Reports

*Initial

Screen Template

*Environmental

And Social Guidelines

*Strategic

Review Templates

*Financial

Review Template

*Due

Diligence Checklist

*Diagnostic

Tool – Questionnaire and Illustrative Graphs

*Outline of Investment Committee

Report

*EVCA

Valuation Guidelines

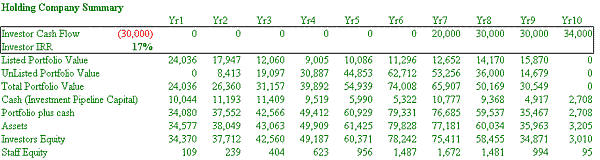

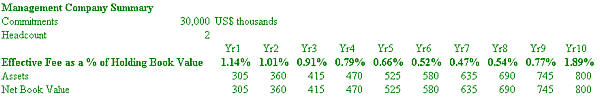

*Proforma

Fund Projections

*Parallel

Analysis Decision Making Model

*Memorandum

and Articles of Association

*Securities

Law Matters

*Taxation

Market & Geopolitics

*Summary

Findings of Global Economic Outlook (UNEP)

*Conclusions

of World Resources Institute Global Resources Analysis

*The

Future of the Global Environment – Analysis by UNEP/RIVM

![]() :

Example Fund Details

:

Example Fund Details

information dated 2004

The Company

The investment management business of GRI Equity involves risk management and asset allocation. Shareholders recognise the particular nature of GRI Investment's business and have agreed that they are suitably qualified to evaluate their participation in the business. (Unacceptable subscribers) The Company itself is not regulated . Each investment is subject to the finance and securities laws, as well as other laws, relevant to the jurisdiction in which the investment is made. The Company, the Manager and executives of the Manager are contractually responsible for investment activities.

Corporate Structure

The following summarises The Company structure and should be read in conjunction with the Subscription Agreement. The Company is established as a self managed holding company incorporated in the [British Virgin Islands]. The Company is constituted by Memorandum and Articles of Association reproduced in Appendix Memorandum and Articles of Association

The Company is established as an offshore holding company to equalise the investment opportunity for all investors. It is registered in [the British Virgin Islands (BVI)]. Prospective shareholders of any nationality and recognised legal identity may apply for subscription. Prospective shareholders should seek their own counsel concerning tax or regulatory issues.

The management is carried out by a wholly owned subsidiary (GRI Equity Management) to maintain congruence of objectives between investors and the management team. Executives of the manager are shareholders of the Company. Executives may be regulated.

Investors agree to maintain The Manager and its team for a period of three years from closing except in the case of a Special Resolution voting for a different action

Graphic Representation of Legal Holding Structure

Investment Strategy

Objective and Focus

The Company is a self managed investment vehicle established to invest in a selected portfolio of globally responsible businesses. GRI Equity will provide long term equity linked capital to businesses via private transactions. All businesses are expected to be unlisted.

GRI Equity aims to obtain net returns to investors of over 15% per annum over the long term. To do this we use our capital to finance product, market and internal development of selected businesses. We also manage information resources to leverage our own activities and those of our partners. Our expertise in financial engineering and business analysis and our experience in reviewing, working in and working with businesses are important skills required to successfully select and manage a portfolio of businesses.

Key investment selection criteria are:

-

A management team with a relevant track record and demonstrated complementary team skills and competencies. An understanding by target management of global management issues. We look for management teams displaying visioning and inspirational coaching approach.

-

A business proposition that is distinctive and commercially attractive.

-

Demonstrated globally responsible initiative.

While our investment policy is inclusive, we will focus on the following areas:

-

Industrial and consumer LOHAS goods and services. In particular, sustainable substitutes for modern needs and conveniences: food, clothing, household, leisure, education and entertainment.

Food - organic, catering, convenience/lowpackaging, local life cycle...

Clothing - organic, local, handmade, sustainable ...

Appliances - low energy, eco-tech, no-chemical ...

Furniture and fixtures - low energy, design, materials, local life cycle ...

Building - materials, design ...

Leisure - eco-toys, educational toys, eco-hotels, eco-tourism/holidays, learning holidays ...

Education - Online learning, learning to .learn, adult education, vocational training ...

Living - banks, insurance, retailing ... -

Information, communications and management technology.

Lower IT cost/risk, WBEM, open source or cross-platform software, materials, telecom services, chaordic systems ... -

Energy.

Alterntative energy especially water, wind, biofuels, solar ... -

Transport.

Eco eg cycles, independent modules, low energy, community systems, -

Waste Management.

Reduction, recycling, reuse, natural purification, eco- cleaning ...

Strategy for Commitments' Application

Commitments are to be fully paid up at subscription. They will be invested in short term AAA rated debt securities or risk free deposit accounts immediately. These deposits will be invested in a selection of stocks selected from GRI Equity' portfolio universe during the first three months.

Initially Commitments will be invested in listed equities. The Manager expects that in the first year of operations the majority of investment of The Company will be in listed securities. It is intended that at least 50% of The Company's assets will be in private investments within three years.

The selection criteria for listed investments are discussed below.

Investment Policy and Restrictions

The business of The Company is carried on subject to direction of the Board. GRI Equity Management is guided by the Investment Policy and Restrictions as laid out in the Agreement and summarised below.

The general approach of the Investment Policy is open rather than restrictive, that is, it tends to present positive screens rather than negative screens. This global approach is necessary to optimise risk diversification of the portfolio. In addition flexibility in accessing opportunities increases the opportunities for appreciation of the Company.

Investment Policy

GRI Equity expects to make private investments expected to be $ 0.5 million to $ 5 million (per holding, i.e. sum of tranches) for a stake of 5% - 50%. Tranches of less than US$ 1 million would be appropriate if follow-on capital is expected to be required in the short term.

The Manager does not seek to take majority stakes in companies, but, at its discretion, may seek management rights for The Company. GRI Equity Management may influence holdings directly through investment agreements, governance or advice. GRI Equity Management may seek to require Holdings to recruit people or pursue other operational initiatives.

While it is not the intention that GRI Equity should take majority stakes, if valuation and business expectations indicate that new capital would demand a majority, this should only be done if a suitable management team is in place.

Syndication is desireable and would be necessary where businesses require larger amounts of capital. It is also desireable if a large percentage stake is to be taken by new investors.

The Company will invest in businesses demonstrating globally responsible initiatives, either in product or service delivery or in business method.

Examples of globally responsible initiatives sought are:

jump to dealflow discussion in review of GRI Equity Management operations |

The Company's geographic investment focus is global. Current deal flow and expected transactions are expected to be in Asia, Europe and North America.

The Company invests in a diverse range of industries. However, particular interest is focussed on LOHAS, IT and management tech, energy, transport, waste and related businesses. Further discussion of the target investment universe is found in the section on the market. (Restrictions are indicated below.)

The principal business stage focus of targets is expected to be product or market development, stage change (e.g. family to professional) and business combination (JV, partnerships, M&A), or divestment (MBO). Startups are being considered.

The Company intends to invest in equity, equity linked or equity-type securities.

Prior to exit, Holdings should meet the Environmental and Social Guidelines and applicable governance, environmental, health and safety regulations of the countries in which they operate. We recognise that these are evolving continually and that regulations or guidelines may be inappropriate in certain environments. In these cases a description of the situation and a recommendation may be made to the Investment Committee.

Restrictions

The Company will not:

-

invest in businesses involved in armaments or military activity;

-

invest in nuclear power businesses,

-

invest in businesses contravening human rights practices;

-

invest more than 25% of Committed Funds in companies operating solely in any particular country;

-

invest more than 25% of Committed Funds in any one sector;

-

invest more than US$ 5 million of Committed Funds in any one company or enterprise;

-

purchase any investment from or sell any investment to a shareholder of the Company without written authorisation from the Board;

-

invest in securities issued by a unit trust, mutual Company or another similar collective vehicle investing in a spread of businesses;

-

deal short, unless the position is fully covered by unencumbered liquid assets;

-

deal on margin;

-

borrow more than 10% of Commitments;

-

give guarantees unless covered by a Company asset.

Subscription Summary

Company Size

The Company is expected to have an initial capital of over US$ 30 million.

[At initiation The Company had commitments of US$ 0.15 million.]

Commitments

Commitments will be in units of US$ 50,000, with a minimum of US$ 250,000 (subject to adjustment at the discretion of the Board).

The Company may admit additional Shareholders until the Last Closing Date on payment of 100% of Capital Contribution, plus interest (see Drawdown). Fees payable to the Manager will be paid retrospectively to the First Closing Date by Shareholders who make subsequent Commitments.

Major Shareholder

Any Shareholder which has a Commitment of US$ 5,000,000 or more is categorised as a Major Shareholder.

Subsequent Commitments

The Board of The Company may make an Extraordinary Resolution to accept further Capital Commitments for up to two years after the first closing. Subsequent Commitments will be subject to interest cost of [8%] if no revaluation is made and [3%] if a revaluation has been made. If the portfolio has been subject to a revaluation this will be reflected in the subscription price approved by the Board.

Drawdown

100% of Commitments will be drawn down on closing.

Subsequent Subscriptions will be also be drawn down in full and will be subject to an 8% interest cost if no upward revaluation of assets has taken place and 3% if a revaluation has been made.

Interest will be treated as income to The Company. It would not be considered Capital Contribution.

Distribution

All realisations of unlisted investments are to be distributed as soon as practicable after the investment is realised with any net income distributed quarterly subject in each case to a minimum distribution of US$ 250,000 in aggregate.

Realisations of listed or pre-listing or IPO investments are to be retained for reinvestment during the 5 years from the Closing Date at the Manager's discretion.

Distributions to Shareholders will be in proportion to the Capital Contribution of each Shareholder.

Distributions in specie are permitted if Holdings are listed. Limited Shareholders may request the Manager to sell their allocation of a distribution and pay them the proceeds rather than receive a distribution in specie.

Company Administration

Regulation

The company is not regulated. Investments are made through third parties that are regulated, thus reducing the conflict of interests that might arise from the Manager having discretionary authority to execute trades.

The Board

Board Composition

The Board is comprised of representatives nominated by the Shareholders owning at least 1% of the Capital (a maximum of one each). The Manager will also nominate a representative to the Board. None of these representatives will receive board fees, although expenses may be paid by the Company.

The Board will monitor application of investment policy, review annual valuations of investments, advise on conflicts of interest and generally review the activities of the Company, Manager and Administrator.

Members of the Board who are not directors or employees of any of the Shareholders or their associates may receive fees fixed by the Board.

Board Activities

The Board is the primary vehicle through which Shareholders may monitor the activities of the Company and the Manager and the Administrator.

The Board reviews annual valuations of unlisted investments and is responsible for monitoring application of the Investment Policy.

The Board monitors the Manager with respect to any conflicts of interest.

The Board meets at least once a year. The Manager and members of its Investment Committee will usually be invited to attend.

Manager

GRI Equity Management Limited is the Manager. The Manager manages The Company and may sub-delegate certain functions.

The Manager is appointed by the Board and is a wholly owned subsidiary of The Company.

The Manager may be changed by the Board by Extraordinary Resolution after three years or by Special Resolution at any time.

The Administrator executes corporate actions under the direction of the Manager or the Board on behalf of the Company. The Manager is not authorised to transfer assets or accept assets of the Company, but is authorised to enter into agreements, subject to approval by the Investment Committee or Board.

Reporting

Summary unaudited quarterly reports and full audited annual reports for Shareholders.

Valuation of Holdings

Valuation of Holdings is made regularly and at least quarterly.

Valuation of Holdings is performed by the Manager and reviewed by auditors annually as part of the annual financial audit. At winding up of The Company the Board may require a third party valuation if, following review by the auditors, there is disagreement on valuation.

The Manager follows the European Venture Capital Association Guidelines on Valuation (issue date March 2001, see Appendix Valuation Guidelines). (You may also review the British Venture Capital Association draft new guidelines here and the BVCA note on internal rate of return here.)

In general, listed investments are valued at market price and unlisted investments are valued at either acquisition cost, the most recent third party transaction price, or a value recognising any permanent appreciation or depreciation in the value of the business. Valuations will generally follow the norms below:

Early stage investments:

-

at cost, less any provision required, until no longer "early stage".

Development stage investments:

-

at cost less any provision required (most common).

-

earnings multiple (next most common) - generally a minimum of 25% discount to the price/earnings multiple of the lowest rated comparable quoted companies.

-

third party valuation (price at which subsequent issue of capital is made).

-

net assets less discount (rare).

Quoted investments:

-

mid-market price.

-

if holding significant or other restrictions - discounts range from 5-25%.

Specifically, valuation of holdings will follow the European Venture Capital Association's Guidelines on Valuation (see Appendix Valuation Guidelines).

Year end

The financial year end of The Company will be 31 December.

Custody

Securities relating to Holdings and Liquid Assets are held by the Custodian and are held in segregated accounts or deposits. Some investments may be registered in the name of a nominee company owned by The Company.

The Manager will not appoint an associate of the Company to be Custodian.

Indemnities

The Company and the Manager [and Administrator] and their employees and agents and members of the Board are entitled to be indemnified out of The Company's assets against all claims, actions and demands made against them in relation to The Company unless arising from bad faith, fraud or reckless or intentional wrongdoing.

The Manager and others are excused liability for actions taken in good faith for a purpose that was reasonably believed to be in the best interest of The Company and when acting on professional advice where appropriate.

The terms of the agreement appointing the Custodian contains provisions indemnifying or limiting the liability of the Custodian.

Taxation for Shareholders

Investors should seek their own advice from professional tax advisors as to their tax status and the likely liabilities that may result from investment in The Company.

Appendix Taxation offers an introduction to some of the taxation issues investors may consider.

Restrictions on Transfer and Preemption Rights

Shareholders may not transfer Company interests without notifying the Board in advance.

Any proposed transfer which would result in the transferee holding more than 15% of The Company requires Shareholder approval.

Transfer of part of a Shareholder's interest is not allowed if following it either the transferor or the transferee Shareholder would have a Commitment of less than US$ 1,000,000.

The Agreement includes preemption rights in favour of other Shareholders on any proposed transfer of a Shareholder's interest unless the proposed transfer is to another Shareholder, an associate of the transferring Shareholder or another client of The Company managing the Shareholder's investments.

Compulsory Transfer

The Agreement contains provisions requiring Shareholders to transfer their interests where necessary under applicable regulatory or securities law (see Appendix Securities Law Matters).

Amendments

The Agreement may be amended by written agreement of all the Shareholders or by Extraordinary Resolution. Certain amendments require consent of all the Shareholders.

Governing Law

The company is incorporated offshore and therefore legal actions may be complicated by multiple jurisdictions, culture and practice. All investors, in subscribing to the Agreement, agree to be subject to arbitration at international law or at European Law in that order of priority in the event of any dispute.

The Company's investment activities will be subject to regulation by various jurisdictions

Representations

The Agreement contains certain representations to be made by each Shareholder in respect of such matters as whether it is a US Person, whether it is a benefit plan investor under ERISA, its financial status, its power to become a Shareholder and its competence to be a Director of the Company.

Unacceptable Subscribers

The authorised persons and signatories of Shareholders of the Company must meet the following requirements:

-

They must be the Shareholder or possess full power of attorney of the Shareholder without recourse to their nominator (e.g. subsequent authorisations required).

-

They must be legally competent.

-

They must disclose material facts concerning their professional conduct, ability or reputation.

If any of these requirements is not, subscription to the Company will not be permitted.

Closing

The Closing Date is [20XX].

Company Economics

Proforma indicative projections of the Company are offered in Appendix Company Projections summarised here:

Fees

A Management Fee based on the Committed Funds is payable by the Company to the Manager, its wholly owned subsidiary, for payment of investment and monitoring costs. (Administration and custodian fees are paid by the Company.) The Management fee may be adjusted by the Board as appropriate, however, it will not be adjusted downwards for the first three years. The fee payable is as follows:

| Commitments |

Management Fee per annum |

US$ 15,000,000 - 25,000,000 |

2.0% |

US$ 25,000,001 - 50,000,000 |

1.5% |

Over US$ 50,000,000 |

1.0% |

A performance fee is not payable. Shares of The Company will be paid to executives as part of their premium/incentive compensation. Shares will be made available for purchase by all employees.

Fees will not be paid to Directors who are associates of any Shareholder. Expenses of all Directors may be subsidised by the Company to the extent permitted by the Company's own policy.

The fees of the Administrator and Custodian will be paid by the Company.

Arrangement, introduction or monitoring fees received by the Manager in respect of the making of an investment in or monitoring a Holding are for the account of the Manager.

Fees for such service and other fees, such as syndication or merchant banking fees, received by associates of the Company or the Manager may be retained by associates. They are disclosed to the Board and may be discussed as part of the annual review of The Company.

Establishment, Formation and Placement Costs

The Sponsor has invested significant resources in identifying GRI Equity' business opportunity and its competitive business model - the Sponsor has incurred significant cash and non-cash expenses in establishment of the Company (Establishment Expenses). Additional expenses directly related to the formation of The Company and the issue of the Securities, including legal, professional and other fees, will become due on formation of the Company (Formation Expenses).

These expenses are for the account of the Company and are expected to amount to [$ 300,000]. At First Closing, [$ 150,000] in cash and [$ 150,000] in shares of the Company will be paid to the Sponsor and the other professionals.

Placement agent fees are not paid by The Company but may be paid by subscribers.

Company Expenses

Expenses chargeable to The Company include:

-

stamp, transfer and registration duties on investments,

-

all legal, accounting and other expenses in relation to dealings in investments,

-

bank charges,

-

fees and expenses of the Board,

-

fees of the Manager (out of which are paid management expenses - the Manager is a wholly owned subsidiary of the Company) and

-

fees and costs of the Auditors, Administrator and Custodian.

back to Market Opportunity * on to The Manager

Home * About * Resources * Investors * Businesses * Members * Admin