Entrepreneur and Business Resources

Integral Methods and Technology

Governance and Investor Responsibility

archive

signup

credits

archive

signup

credits

Private and Confidential

August 2007

- Perspective

- Investment, finance & VC * Interest rates and currencies * Trade & FDI

- Activities and Media

The following sections are delivered through Astraea. The links below will take you to those sections.

Perspective

Living

in a fantasy world ...

Living

in a fantasy world ...

You may have heard of the downturn in financial markets recently. Its quite serious in fact. Though at the moment what's happened is only heightened volatility coupled with a modest correction in asset prices which has merely eliminated the optimism of the past few months. Unfortunately it will continue because the fantasy of creating something from nothing must be unwound. The irresponsible expansion of credit fuelled consumption has exceeded our ability to pay our debts. As you can read in the section on Investment, it has been too easy for us all to buy "stuff" with money we don't have. Our propensity for greed fuelled by envy has become immoral. And this does not account for the wasted investment in war (which has simply been a money pit), corruption and, unfortunately, below standard infrastructure. This is OK because it can all be blamed on human nature. But that means us. And unless we bring back morality into our personal lives the pain of correction will be exacerbated. Unwittingly our values reflect the fantasy of Hollywood more than the reality of nature.

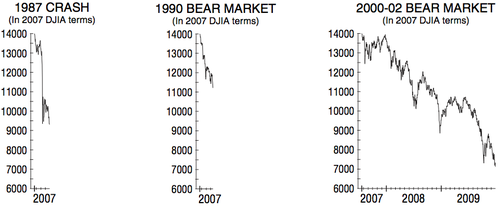

The mechanism that underlies the sub-prime crisis is a good illustration of the fantasy that we have created. Fiduciaries (people that are supposed to be responsible for other people's money) grouped together many loans then repackaged them into another group of loans based on the original group. The second group of derived loans were then sold on and by collusion and misinformation the sum of the second group became more valuable than the first group even after the costs of doing the work. Its like dividing a cake and then putting the pieces back together and having a bigger cake than that you started with, even though crumbs (sometimes big crumbs) have been eaten in the process! This is the fantasy. And we've created other fantasies, like children without parents or self control in an unattended sweet shop. It is fantasy to advocate free trade while you subsidise your producers. It is fantasy to expect full employment while encouraging automation without education and training to ensure that people can move up the skills ladder. It is fantasy to believe that you can take more out of the earth than is put in.

This financial discomfort is only going to be short term. But it is another severe warning which will touch more lives than a tsunami, hurricane, flood or heat wave. We're living a bigger fantasy that needs to be unwound before the quake occurs. That is the fantasy that this biosphere can support 6 billion people (and more). Malthus was right, but he did not count on fossil fuels, especially oil. Petrol has fuelled an exponential growth in consumption during the past century. A hundred years ago human consumption was more closely equal to the energy input of the sun to our biosphere. In the past 100 years we've sucked energy, stored over millennia, out of the ground and burned it to create cars, TVs, cities and ... people. We believe it's all normal and OK. But it's not. And we've begun to feel the tremors of a planet self-destructing. While the biosphere is likely to survive, there is no way it will continue to tolerate the footprint of humanity. And while we feel the pain of repossessions, reduced consumption and uncertainty with a brief financial tremor, the lifestyle change that is inevitable in our lifetimes is inconceivable.

Some enlightened intentional communities have started to initiate transition to infrastructure and dynamic which explore enlightened technology like alternative energy, open systems and organic food. These are communities of leading thinkers who have gathered together to experiment with redesigning society in a world without oil. These initiatives are not insignificant and are the laboratories of future living. They do not advocate regression to the stone age. But they are innovating choices about how to continue the rich, varied and stimulating lifestyle that we now enjoy, without sucking the planet dry. We have built up a massive ecological credit in the past century and the biosphere's banker has decided that our credit rating needs to be reconsidered.

The impending restructuring of global economics is an opportunity to embark upon system change. And that starts with us as individuals. We are irresponsible if we look to leaders to show us the way. That is an abdication of responsibility. We must each take a step in the right direction. We must face the fear of change and realise that we all know how to do the right thing the right way. We can apply the standards that we have for our children and leaders to ourselves. We are not powerless. We must face the fact that being unable to do everything does not mean that we should do nothing. Once we take a step in the right direction we soon realise that the reality of nature is as wonderful as the fantasies created by financial credit and feudal power structures.

Investment, Finance & VC

(The investment section is dominated this month by notes on the credit crunch precipitated by realisation that risk/return profiles in US housing finance and global credit are out of line.)

Hello, moral hazard. No, there is no free lunch.

The unwinding of imbalances in the world of money continued in August. While we will make a number of observations in this month's review, the story has not changed. And while the outlook is not easy to determine, the principal driver is unchanged. Last month we highlighted the new appreciation investors have adopted for risk. Previously it was hardly considered, now it is high on the agenda. This month the buzz word is uncertainty. Unfortunately that is a step beyond risk.

The financial markets face uncertainty, rather than risk. My portfolio theory professor at Wharton helped us understand the difference as risk being a defined variation or defined probable outcomes, uncertainty, however, is not even knowing what possible outcomes might be. With the increasing sophistication of securities and their derivatives understanding the underlying drivers of an asset has become more elusive. The interconnectedness of assets and the gross negligence of due diligence in committing capital over the past five years means that even the most sophisticated analysts have difficulty identifying real data. With that proviso, let's review some of the news and views ...

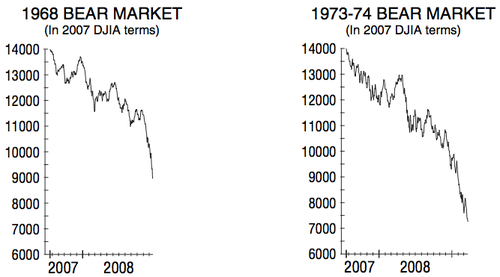

The general theme is that the markets are down, credit is tighter, liquidity has been made available to banks and investors are hoping for a drop in interest rates in mid-September. But don't imagine we've had a real correction. Via Jim Stack's Investech, comes this interesting view of how prior bear markets compare relative to the most recent 9% correction. That's right, the drop these last few weeks hardly registers. Global stock markets are down, but not heavily. The S&P fell less than 10%, before rallying. The comparison with Black Monday in 1987, when Wall Street fell 17% in a single day, is very wide of the mark. Most market are still up on the year - some marginally, like US, some substantially like Korea, Brazil, and Germany. The dogs which didn't bark are emerging market bond spreads, which remain tight by historical standards, and shipping rates and commodities.

But the correction is healthy because it has refocussed attention on the other side of investing, the down side. Now asset managers are reconsidering things like risk, security and loan terms.

(We won't be seeing so many NINJAS!

As far back as 2001, advocates

for low-income home-owners had argued that mortgage providers were making

loans to borrowers without regard to their ability to repay. Many

could not even scrape together the money for a down payment and were being

approved with little or no documentation of their income or assets. In

the most extreme cases, mortgage brokers were handing out what came to

be known as "NINJA" loans, to people with no income, no job and no assets.

Often the loans were "no-doc", where the borrower did not have to provide

proof of how much they earned. Recent research suggests that in many if

not most of these, borrowers (or their brokers) lied about their income.

But now as interest rates have risen, so have repossessions. The US housing

market has collapsed, and the banks find themselves saddled with a lot

of bad debts. In December 2006, the first subprime lenders started

failing as more borrowers began falling behind on payments, often shortly

after they received the loans. And in February, HSBC,

the UK bank, set aside $1.76 billion because of problems in its American

subprime lending business.)

What is needed now is confidence and trust in the market, not a bail out that perpetuates moral hazard. Let's see whether regulators and central banks can give us the tough love that the market needs. If the US Fed reduces rates on 18 September, we know that a bail out is preferred.

The Fed lowered the discount rate, and the administration has initiated reform of tax laws to help troubled borrowers refinance their loans. Even so, Bernanke insisted it was not the job of the Fed "to protect lenders or investors from the consequences of their financial decisions", and President Bush said that it is not the government's job to bail out speculators.

While it is questionable whether or not a reduction in the Fed funds rate would resolve any of the problems of over-borrowing, Bernanke has said that "The Fed stands ready to take additional actions as needed to provide liquidity and promote the orderly functioning of the markets." This may be the rationale behind a lowering of rates, but would only serve to fuel speculation instead of allowing the market to develop its own discipline. A reduction in rates would induce a brief surge, but like that in Iraq, it would be relatively impotent. The cycle induced would be much shorter because the memory of the pain from July and August is fresh and investors want to lower risk now, not increase returns.

As an aside, Bernanke may be in the hot seat, but many analysts are beginning to review their evaluation of Greenspan's performance as Fed Chair. Supporters of Greenspan may claim that his role was not to advise investors, but the low level to which interest rates were dropped is increasingly questioned because it encouraged a consumption boom born of mortgage equity withdrawal underpinned by low cost debt. My concern now is that similar strategies will be employed to lessen the consequences of fiscal profligacy and economic imbalances.

The US policy outlook is uncertain. It is fine to lubricate financial markets to allow an adjustment to take place gradually, but to bail out the market perpetuates the illusion that downside is limited. The moral hazard allows imbalances to build which reduces productive capacities of society. Worse is the habit of bailing out the market from the top, rather than the bottom. In other words banks, asset managers, brokers, professionals, agencies and other fiduciaries are bailed out while the least protected are allowed to suffer. And this suffering is usually very personal and painful - people with little have that taken away. Retired home-owners and young families have their houses repossessed. Let's hope that this does not happen.

A

bail out of bigger players might be rationalised by the idea that "investors

were persuaded to buy complex packages of securities by prime brokers".

But this is a dangerous and self-serving excuse. All of the big

players (including individual investors) are sophisticated fiduciaries

who can tell the difference between transparency and an opaque opportunity.

They could have asked the right questions. Due diligence was

in fact minimal. There should be no bail out at the top of the

investment pyramid. Penalties should be imposed upon the brokers

and lenders who effectively took advantage of naive home owners or young

families - the sub-prime target market -

A

bail out of bigger players might be rationalised by the idea that "investors

were persuaded to buy complex packages of securities by prime brokers".

But this is a dangerous and self-serving excuse. All of the big

players (including individual investors) are sophisticated fiduciaries

who can tell the difference between transparency and an opaque opportunity.

They could have asked the right questions. Due diligence was

in fact minimal. There should be no bail out at the top of the

investment pyramid. Penalties should be imposed upon the brokers

and lenders who effectively took advantage of naive home owners or young

families - the sub-prime target market -

So far the pain has been concentrated in alternative assets and those exposed to them, managers and intermediaries. The stock market declines are not serious enough to indicate a large-scale macro event, and the globalisation story remains largely intact. Too much capital went into alternatives. Return expectations were too high, and strategies too similar. The sub-prime meltdown, a medium-size problem, triggered industry-wide deleveraging which ended up hurting everyone involved. But at the end of the day the alternatives industry is not that important and other sectors are more relevant. However, the vibration from a handful of sub-prime lenders and blue-chip hedge funds disintegrating has changed the perception of investors and lenders. It is a good opportunity for the unwinding of the credit build-up of the last five years. We can only hope that the decline in valuations is gradual. But I'm afraid the correction this time may not be enough to galvanise a system change.

There remains great opacity about the state of leverage and interconnectedness, such as the use of hedge fund positions (which are leveraged) being used as collateral for further loans for investment. The kind of layered leverage which Enron was so good at hiding, until it wasn't. Barry Ritholtz asks whether it isn't a house of cards illustrated by the term CDOn - a generic term for CDOs backed by other CDOs, ranging from CDO2 to CDO3 to CDO4 and so on! Similar opacity has been created by the degree to which special purpose vehicles have been used to market products, or to circumnavigate restrictions, either internal or regulatory. This Enron risk is evident, however its extent is not, and there is a strong incentive to keep it that way for those exposed to deteriorating market values.

Last month we noted the role rating agencies played in helping create a distorted evaluation of risk/return profiles. This has become clearer as we reflect on the evolution of rating policy and rising sophistication of derivatives. What occurred was that regulators required pension funds to restrict investment to A grade securities, but failed to adapt regulation of ratings to the changing nature of securities in a market moving from "book to hold" to "originate to distribute". Rating agencies, initially reluctant to rate tranches of securitised sub-prime portfolios, became involved in their creation and found them to be a large, attractive source of revenue - they had strong incentives to be generous to their paymasters.

Although there is evidence that Moody's and S&P remain relatively conservative when rating structured products, it is clear that even they allowed their ratings scale for securitised products to become inflated. Bloomberg Markets reported in July that: "Corporate bonds rated Baa, the lowest Moody's investment grade rating, had an average 2.2% default rate over five-year periods from 1983 to 2005, according to Moody's. From 1993 to 2005, CDOs with the same Baa grade suffered five-year default rates of 24%, Moody's found." In other words, long before the current crisis, Moody's was aware that its Baa CDO securities were 10 times as risky as its Baa corporate bonds. Given the different and shifting meanings of Baa and other ratings as measures of risk and given the high rate of financial innovation and the lack of transparency inherent in multi-layered structured finance deals, it is not surprising that investors underestimated risks so badly leading up to the recent crisis.

And it wasn't just rating agencies and the buyers of tranches that had a distorted (or opaque) picture of the risk/return profile. There was asymmetric information throughout the value chain. And the asymmetry is less about information differential on either side of a transaction (except between the sub-prime borrower and the mortgage broker), but more about a difference between what both parties thought the deal was and the reality of the risk/return profile. The originators did not know much about the underlying mortgages, the buyers less. The rating agencies knew little about the products they rated, investors even less. Borrowers hardly understood what they were getting in to and lenders did not know who they were lending to; mortgage brokers were getting paid for closing deals not for building a well understood portfolio of loans.

My conjecture is that the problem of overvalation is spread among many market participants and therefore will be felt across the global economy, but only to a great extent by a few participants heavily weighted in risky portfolios (most likely because they were (greedily) pursuing super returns) and focussed in the US. If interest rates are not brought down, the market will adjust and the majority of investors will feel the consequences of their decisions, and, hopefully, market discipline will increase. This will help stabilise economic dynamics in the future. If on the other hand, interest rates are reduced, the worst offenders will benefit the most, moral hazard will be exacerbated and the market will not learn. The next shock, will be equally disruptive and occur within a year (probably much less).

System change would be welcome.

While

the news has been dominated by financial markets' liquidity concerns,

another spectre raised its head in August - deteriorating infrastructure.

In America the collapse of a Minneapolis bridge caught people's attention

and while it is unlikely that infrastructure is going to start collapsing,

it is the case that the cost of maintenance and repair is high and rising

and the condition of infrastructure is well below its condition when installed

thus reducing its efficiency and raising its usage costs (eg time lost,

wear and tear on vehicles and passengers). The American Society of

Civil Engineers, grades the nation. Issuing its first report, in 1988,

it issued three Bs (for aviation, flood defences and drinking water) and

one D. All other systems were graded C. In sum, a slow pupil, but not

a hopeless one. By 2005 America was a drop-out, with no As or Bs, four

Cs and ten Ds. Worryingly, the second-best grade went to the nation's

bridges. It is not just America. Many will have felt the pressure

in air travel, or congested roads. In Ireland (a small player) some

analysts fear that corruption has raised the cost and lowered the quality

of massive infrastructure build out over the past decade or so.

(One story of a contractor complaining that motorway siding they had installed

did not work, then to be told that they had installed it upside down,

thereby resulting in an additional cost of some € 7 million, illustrates

the harm that comes from getting incompetent friends to do the work.)

These signs suggest that economic efficiencies will be dampened and if

a long term slowdown does ensue, we will be spending more on repairing

modern infrastructure than we should - which will exacerbate and extend

the pain of economic slowdown.

While

the news has been dominated by financial markets' liquidity concerns,

another spectre raised its head in August - deteriorating infrastructure.

In America the collapse of a Minneapolis bridge caught people's attention

and while it is unlikely that infrastructure is going to start collapsing,

it is the case that the cost of maintenance and repair is high and rising

and the condition of infrastructure is well below its condition when installed

thus reducing its efficiency and raising its usage costs (eg time lost,

wear and tear on vehicles and passengers). The American Society of

Civil Engineers, grades the nation. Issuing its first report, in 1988,

it issued three Bs (for aviation, flood defences and drinking water) and

one D. All other systems were graded C. In sum, a slow pupil, but not

a hopeless one. By 2005 America was a drop-out, with no As or Bs, four

Cs and ten Ds. Worryingly, the second-best grade went to the nation's

bridges. It is not just America. Many will have felt the pressure

in air travel, or congested roads. In Ireland (a small player) some

analysts fear that corruption has raised the cost and lowered the quality

of massive infrastructure build out over the past decade or so.

(One story of a contractor complaining that motorway siding they had installed

did not work, then to be told that they had installed it upside down,

thereby resulting in an additional cost of some € 7 million, illustrates

the harm that comes from getting incompetent friends to do the work.)

These signs suggest that economic efficiencies will be dampened and if

a long term slowdown does ensue, we will be spending more on repairing

modern infrastructure than we should - which will exacerbate and extend

the pain of economic slowdown.

What have Americans gained from their nation's mountain of debt? A crumbling infrastructure, a manufacturing base that has declined 60% since World War II, a rise in the wealth gap, the lowest consumer-savings rate since the Great Depression, 50 million Americans without health insurance, an educational system in decline and a shrinking dollar that makes foreign travel a luxury. As Hamid Varzi notes, a return to fiscal responsibility would make America far stronger, both domestically and internationally, than would a continuation of current policies that falsely project strength through protectionist threats and military aggression.

Central banks have added an additional € 0.5 - 1 trillion in short term liquidity around the world. That is certainly in excess of the exposure to the sub-prime sector. But what is that cash for? Its to tide banks over until they can sort out their balance sheets, not a gift. They will be paying interest on the money lent while they try to restructure loans. Lending terms will be tougher again. Goodbye to ninja loans. And how long will it last? The pressure on the market must remain for one to two quarters and more rigorous terms should remain indefinitely (though that's unlikely). We expect that stock markets should continue to correct, and then will rise again at a more modest pace. The US economy will remain under pressure, whereas China will continue to underpin global prosperity.

While the focus in rightly on America, remember that all rich economies have been playing a similar game and the global economy will suffer. Where credit has been used to pay for consumption instead of investment the pain will be greatest.

What investment strategy might be pursued? Well, the first priority these days is to focus on the return OF capital rather than the return ON capital. Having said that, gold has become popular and is already hitting $ 700 an ounce, because it is seen as a low risk asset. But it is a traders investment and not one that we would focus on. Blue chips are also worth considering for their lower risk profile. In general, the simple rules of fundamental valuation should be applied. Paying too much now, will be costly later.

And three links which offer further fuel for thought:

BBC's Q&A on world stock market falls

In mid-August investment guru Jeremy Grantham analysed

the private equity market. In this article he notes that it

is one thing to make money when debt is cheap, but another when capital

costs rise. While he focusses on private equity, and leveraged deals,

his observations are relevant for businesses in general and therefore

relevant generally to investors and analysts.

Bankers have always got flak from charging interest. This is inappropriate because everyone values time and that is what interest accounts for. While the subprime implosion rattles markets, new research from a case study in South Africa shows that lending to the poor benefits them. And is cost effective for the lender to take on extra risk. The Economist's summary of the research is here.

Responsible Investing

A few anecdotal benchmarks on the SRI market are worth noting. The size of the assets under management is now estimated to top $ 1,000 billion and many listed companies are trading at multiples of 40 - 50 times earnings. There is no doubt that a boom in clean tech investing has occurred since last autumn/fall when a raft of reports legitimising climate change were released, like the Stern report and IPCC reports. This has resulted in high valuations in both the private and public markets and there is no doubt that expectations will not be met. It is also fair to expect that a significant portion of the new capital will have been wasted by encouraging businesses into gratuitous spending - this is normal and always happens when money managers are falling over themselves to invest (and some have little grounding in what they are doing). With the current downturn in the market, it may be that over the medium term (1-3 years) these investments may not perform too badly relative to non-SRI portfolios, which would help preserve the reputation of the sector. What is also happening though is that all mainstream asset managers are incorporating some kind of SRI screening in all their fund management procedures. This is simply a pragmatic and cost effective way of reducing investment risk. It requires a more sophisticated view of opportunities, because the analysis of non-financial dimensions becomes more important than it has been. But investors should remember that it is they who are driving this trend and they must remain diligent in their selection of funds and managers.

According to a new survey from EyeForProcurement, more than 50% of companies have policies on greening their supply chain, and companies are nearly unanimous in their belief that green supply chains will only continue growing. The survey asked 188 procurement professionals, primarily in the United States, Europe and Asia, about their companies' practices, policies and plans for reducing the environmental impact of the materials used in their work. The two most heavily represented sectors in the survey were the transportation/logistics fields and the high-tech industry. The retail and apparel sectors were minimally represented, which suggests to the study's authors that going green is not a high priority for businesses in that field. The vast majority of products that companies are sourcing sustainably are packaging materials and the raw materials used in manufacturing, with 29% and 24% of respondents purchasing those materials from sustainable sources. Two-thirds of the professionals in the survey said that they are practising green procurement to support their companies' environmental or sustainability strategies, while 49% also said they're responding to customers' interest in eco-friendly products and services. Although companies are increasingly aware of the benefits and importance of green procurement, most of them are only acquiring a small portion of their materials in that way. Only 13% of respondents are sourcing half or more of their products and services sustainably, while 55% said they source less than 10% of green goods.

In most countries, companies have no legal responsibility to issue sustainability reports that focus on the social, environmental, and governance ramifications of their business activities. However, more and more companies are responding to internal and external demands to create these reports with, for example, almost half of the S&P 100 corporations writing sustainability reports in 2006. A new study from GRI and KPMG on sustainability reports notes that companies highlight new business opportunities created by climate change and shy away from risks associated with climate change. As you will see from the summary information below, this is demonstrates a massive opportunity: for some years now the opportunity to change business systems and culture to moderate operational risk has been evident, but apparently ignored, and the investment opportunities (other than "alternative energy") also evidently attractive, have similarly been ignored. The GRI / KPMG Global Sustainability Services study reviewed sustainability reports from 50 companies that follow GRI's guidelines. The newly released research, entitled Reporting the Business Implications of Climate Change in Sustainability Reports notes that 90% of surveyed reports include climate change, however, only 20% of the studies reports mention any risks to their businesses from climate change. This lack of information on risks is in spite of evidence from a number of sources, including the Stern Report on the Economics of Climate Change, that say that climate change has serious ramifications for the world's economy. The report concludes that carbon emissions trading and credits are the most focused on as new businesses opportunities created by climate change. Other opportunities from climate change vary widely from sector to sector, and include hybrid cars to energy efficient detergents.The risk that was mentioned in the reports most often is the increase of energy costs, with about 20% of sustainability reports mentioning rising energy bills. Very few companies mentioned the risk of increased legal action, such as the risk of class-action lawsuits with regard to climate change.

The World Business Council for Sustainable Development officially launched its new Global Water Tool, designed to help companies and organizations to map their water use and assess risks relative to their global operations and supply chains. The launch coincides with World Water Week in Stockholm. Companies around the world are exposed to risk from water issues, and provision of clean water is a rapidly growing industry. Nearly every firm is a consumer of water at some point in its supply chain, and understanding usage of this vital resource is becoming increasingly important. Around 10% of the world's population currently lives under water stress as defined by the United Nations, and the UN predicts that by 2025, two-thirds of the earth's population will be living in areas suffering from scarcity of water. Increased water use due to growing populations and economic development, as well as droughts and changes caused by climate change will likely worsen the situation. Under the old business adage “what gets measured, gets managed”, WBCSD says the tool should help companies better manage their water use. Better local management leads to better global management. The tool is downloadable from www.wbcsd.org/web/watertool.htm . The Global Water Tool allows companies to quickly and accurately answer such key questions as: How many of our sites are in extremely water-scarce areas? Which sites are at greatest risk? How will that look in the future? How many of our employees live in countries that lack access to improved water and sanitation? How many of our suppliers are in water-scarce areas now? How many will be in 2025? It does not provide specific guidance on local situations, which require more in-depth, systematic analysis. The tool also enables companies to quickly and accurately: Compare their water use (including staff presence, industrial use, and supply chain) with validated water and sanitation availability information, both on a country and watershed basis; Calculate water consumption and efficiency; Establish relative water risks in their portfolio; Create key water Global Reporting Initiative indicators, inventories, risk and performance metrics; Enable effective communications between internal and external stakeholders on water issues.

Standard and Poor's launched its Global Thematic Index Series, which includes the S&P Global Clean Energy Index. Merrill Lynch expanded its line of "green" indexes with a new product, the Energy Efficiency Index, that tracks the growing movement to reduce energy costs and CO2 emissions. The EEI has a universe of 40 global companies found in four sectors that should benefit from improved energy efficiency. Other well-known indexes that follow clean energy include the WilderHill Clean Energy Global Innovation Index, the NASDAQ Clean Edge U.S. Index, the KLD Global Climate 100 Index and the Ardour Global Indices

If you are an SRI investor have a look at Natural Investing. This investment advisor was launched by experienced professionals and it seems that their work is driven by much of the empathetic passion that drives GRI Equity. Worth a browse for private investors and investment managers.

Venture Capital

Grant Thornton released a report on the ethics of the private equity industry (focussed on the UK). Unfortunately their methodology was flawed: they surveyed private equity pros and asked them if they feel ethical! As you guessed, most private equity pros say that their industry has “high” ethical standards. Oh dear. That doesn't sound very ethical. As Dan Primack suggests, wouldn't it be great to do a qualitative review of actual private equity transactions, which would include interviews with equity sponsors, portfolio company management and portfolio company employees. (Anyone want to sponsor us to do such a survey?)

While risk perception has raised volatility and reduced market liquidity, there is apparently still enough discretionary capital to raise a few billion for restructuring private equity. Oaktree Capital ($3-5 billion), Goldman Sachs ($ 1 billion) and Lehman Brothers ($ 2 billion) are already well on their way to closing funds totalling $ 6 - 8 billion to buy bridge (not the road and rail kind) financing debt that has stalled because of market concerns.

China has begun selling Yuan 600 billion ($79 billion) in bonds to finance a state agency that will invest the country's foreign currency reserves. The bond sale was the first tranche of a Yuan 1.55 trillion ($199 billion) basket of special treasury bonds, approved in June by China's legislature. The interest rate is about 4.3%, matching the market rate for long-term debt. The fund could end up managing between $200 billion and $400 billion. China is setting up the agency, tentatively called the State Investment Co., to make more profitable use of its $1.2 trillion in reserves, of which and estimated 70% are in U.S. Treasury securities and other US$ assets; the remainder is thought to be in euros and a small amount in yen.The growth in China's reserves has been driven by its surging exports, which bring in a flood of foreign currency. That's forcing the central bank to drain billions a month from the economy by selling bonds to reduce pressure for prices to rise. The reserves are growing by about $20 billion a month. Chinese officials say the investment agency is modelled in part on Singapore's state-owned Temasek Holdings, which invests in banks, real estate, shipping, energy and other industries in Singapore, India, China, South Korea and elsewhere. The investment vehicle has already made one investment, valued at $3 billion, in the U.S. private equity investor Blackstone Group. That investment has not panned out, as Blackstone shares have plummeted 34% since an initial public offering in June.

US venture capital performance continued to show positive returns across most investment horizons ending 1Q 2007. The NVCA puts average five-year returns for all VC at 2.7%, with far stronger performance for one-year (18.1%), three-year (9.6%), 10-year (21%) and 20-year (16.4%). Only the five-year underperformed the Nasdaq or S&P 500, and that can be chalked up to venture getting hit particularly hard by the Internet bubble burst. But after hearing the conjecture that the majority of VC funds have underperformed for nearly a decade, Dan Primack of Thompson did some analysis and notes the following:

"Through the end of Q1 07, funds raised between 2001 and 2007 have a median IRR of -2.6%. Moreover, the super quartile benchmark was at just 4.1%, which means that the vast majority of VC funds raised since 2001 have underperformed a typical savings account. The data beginning in vintage year 2003 is even worse (which is probably to be expected with the J-curve). The median for these funds is -5.7%, with the upper quartile benchmark at -0.2%. That’s right, more than 75% of VC funds raised since 2003 were underwater through the end of Q3. VCs were paying relatively low valuations for companies between 2003 and 2005 (or at least should have been), and the IPO and M&A windows have been steadily improving. If most funds are losing money in that environment, then what happens when some of today’s inflated valuations – particularly in clean-tech and later-stage deals – come home to roost?"

Venture capitalists invested $7.1 billion in 977 deals in the second quarter of 2007 - the highest level of deals reported in a quarter since Q3 2001 - according to the MoneyTree Report by PricewaterhouseCoopers and the National Venture Capital Association based on data by Thomson Financial. The quarterly strength in the number of deals was driven by companies in the Seed and Early stages of development, which increased by 31% from the prior quarter. Venture Investment Q2 '07 - MoneyTree

Reklaim Technologies Inc. has secured $7 million of a $10 million Series B round led by Goldman Sachs, according to a regulatory filing. The US company is developing a climate-neutral solution to recover materials and trapped energy from discarded products such as tires, computers and automobile plastics.

HerbalScience Nutraceuticals LLC, a Singapore-based developer of a botanical extraction technology, has raised an undisclosed amount of convertible preferred funding, from Aisling Capital and Weston Presidio. VentureWire reports that the deal was $28 million for a 25% stake. BMO Capital Markets served as placement agent.

Propel Biofuels Inc., a developer of biodiesel pumps for existing service stations, has raised $4.75 million in its first institutional funding round, according to VentureWire. Backers include @Ventures and Nth Power.

Solexant Corp., a US developer of low-cost photovoltaic cells, has raised $4.3 million in Series A funding, according to a regulatory filing. Backers include Trident Capital, Firelake Capital and X/Seed Capital.

HelioVolt Corp., a Texas-based developer of thin-film photovoltaics, has raised $77 million in Series B funding. The round was co-led by Paladin Capital Group and Masdar Clean Tech Fund, an affiliate of the Abu Dhabi government. Series A backer New Enterprise Associates also participated, alongside Solucar Energias, Morgan Stanley Principal Investments, Sunton United Energy and Yellowstone Capital.

SunEthanol, an US developer of cellulosic ethanol production technology, has raised an undisclosed amount of VC funding from VeraSun Energy Corp, Battery Ventures, Long River Ventures and AST Capital.

Venture Vehicles Inc., a Los Angeles-based maker of "green-friendly" automobiles, has raised $6 million in Series A funding, according to a regulatory filing. Backers include NGEN Partners and DVC Technologies NV.

ArcLight Capital has agreed to acquire interests in 18 geothermal, wind and solar renewable power generation projects from Caithness Energy LLC. The projects have an installed capacity of 824 megawatts. No financial terms were disclosed.

Laureate Education Inc. has completed its $3.82 billion take-private acquisition by a consortium that included Laureate chairman and CEO Douglas Becker, Kohlberg Kravis Roberts & Co., Citi Private Equity; S.A.C. Capital Management, SPG Partners, Bregal Investments, Caisse de dépôt et placement du Québec, Sterling Capital, Makena Capital, Torreal SA, Brenthurst Funds and Vulcan Capital. Laureate stockholders received $62 per share. Laureate is a Baltimore-based provider of on-campus and on-line higher education.

Interest Rates and Currencies

The hope of August has been that the US Fed will lower interest rates in mid-September. I do not think this should happen, but there might be more emotional pressure on the Fed Chair and the OMC than we realise. A reduction in the rate would give support to the stock market but not help improve fundamentals. In fact it would contribute to moral hazard (as discussed above in Investment). A rate cut will not make a difference in the credibility of the ratings, nor will it transform bad debts into good ones. I don't think that interest rates should come down. They are where they need to be. And the problem in the financial markets has been over-leverage. The lesson needs to be learnt and both lenders and creditors should be allowed to learn.

Interest rates are not high and consumption remains strong in America. The US economy grew at an annual rate of 4% in the second quarter, a better performance than first thought. Revised figures from the Commerce Department showed the economy fared better than its initial forecast of a rate of 3.4%. The rise, eclipsing the 0.6% growth seen between January and March, was due mainly to strong business investment. US retail sales, which account for more than two-thirds of the US economy, rebounded more than expected in July. Overall sales at US retailers rose 0.3% in July, compared with June's 0.7% drop, and better than the expected 0.2% rise. The core retail sales figure, which excludes building materials, cars and petrol rose to 0.6% in July from 0.4% in June. It has not yet become apparent that consumers have changed habits.

What has happened in the last few weeks is a massive injection of cash.

An estimated $ 0.5 - 1 trillion more than normal has been lent by central

banks, mainly in Europe and Japan. And the US Fed reduced the discount

rate (the rate at which it lends to banks overnight). This injection

of liquidity would normally contribute to inflation, which continues to

be undesirable. While core US consumer prices, which exclude food

and energy costs, rose by 0.1% in July, compared with market expectations

of a 0.2% expansion, and the Commerce Department said the annual level

of consumer price inflation was 1.9%, below where it stood earlier this

year and within the Fed's unofficial 1% to 2% comfort zone, as discussed

below, the annual rate will keep rising because of high inflation in the

first half of the year.

Inflation is not under control in the US. Read the following extract from the US Bureau of Labour Statistics July CPI report (available in full here):

During the first seven months of 2007, the CPI-U rose at a 4.5% seasonally adjusted annual rate (SAAR). This compares with an increase of 2.5% for all of 2006. The index for energy, which rose 2.9% in 2006, advanced at a 21.3% SAAR in the first seven months of 2007 despite registering declines in each of the last two months. Petroleum-based energy costs increased at a 36.9% annual rate and charges for energy services rose at a 3.8% annual rate. The food index has increased at a 5.7% SAAR thus far this year, following a 2.1% rise for all of 2006. Excluding food and energy, the CPI-U advanced at a 2.3% SAAR in the first seven months, following a 2.6% rise for all of 2006. The food and beverages index rose 0.3% in July. The index for food at home, which increased 0.6% in June, rose 0.1% in July. Another sharp increase in the index for dairy products was nearly offset by declines in the indexes for fruits and vegetables, for meats, poultry, fish, and eggs, and for nonalcoholic beverages. The index for dairy products increased 2.7%, following a 3.2% increase in June. Milk prices rose 6.4% and have risen 16.9% since the beginning of the year.

Moving on to exchange rates, the dollar has not deteriorated despite market volatility. But in order to continue borrowing at reasonable interest rates America, which borrows a $2.5 billion daily from abroad to service its burgeoning debt, needs to retain credibility with its overseas creditors, especially Asian nations running huge trade surpluses. A cessation of foreign lending would force the Fed to raise interest rates to attract money, accelerating the economic rebalancing in the US. The U.S. debt situation is such that the Chinese would not even need to "dump dollars" to precipitate a meltdown but could simply refuse to extend further credit: They could cease purchasing additional Treasury Bonds and Treasury Bills, without selling any excess inventory. China has the far stronger hand, because a run on the dollar would merely reduce China's gigantic cash surplus while increasing America's debt burden to astronomical levels.

Last

month we shared some data on foreign exchange holdings and global investment

patters which indicate that a reallocation from US dollars to other

currencies is occurring and underpinned not just by the $5 trillion or

so held by central banks, but also by the $ 20 trillion of so in US real

money management accounts. The recent moderation of equity markets

has reinforced this rationale. Investors, including those in the

US, are likely to be reconsidering their risk profile of US markets

and others that are exposed to housing downturns and rising capital costs.

At the same time they will be looking for good returns. Both of

these criteria can be satisfied by investing in emerging markets, and

the wealthiest have access to these markets both in listed markets and

also in direct investment (PE and VC) markets. I expect that this

reallocation will accelerate and a portion of capital divested in recent

weeks may be reinvested in emerging markets.

Last

month we shared some data on foreign exchange holdings and global investment

patters which indicate that a reallocation from US dollars to other

currencies is occurring and underpinned not just by the $5 trillion or

so held by central banks, but also by the $ 20 trillion of so in US real

money management accounts. The recent moderation of equity markets

has reinforced this rationale. Investors, including those in the

US, are likely to be reconsidering their risk profile of US markets

and others that are exposed to housing downturns and rising capital costs.

At the same time they will be looking for good returns. Both of

these criteria can be satisfied by investing in emerging markets, and

the wealthiest have access to these markets both in listed markets and

also in direct investment (PE and VC) markets. I expect that this

reallocation will accelerate and a portion of capital divested in recent

weeks may be reinvested in emerging markets.

China's inflation rate jumped to 5.6% in July, year-on-year, up from 4.4% in June and its highest level for more than ten years. Rising food prices were to blame and the central bank expressed concern. China raised interest rates for the fourth time this year. This is part of an ongoing policy to keep inflation moderate, manage exchange rates and provide some rein on the booming stock market. Capital controls were also eased by allowing investment by mainland nationals in the Hong Kong market. This may take some of the pressure of Shanghai and Shenzhen and even provide a boost to Hong Kong.

Japan's economy grew by only 0.1% in the second quarter, below market expectations of 0.2%. Japan's weak 2Q economic growth was led by modest exports. The yen has appreciated making goods more expensive abroad. The government's latest economic figures came as the Bank of Japan announced a second cash injection of 600 billion yen (US$5 billion) into money markets, its second intervention in two trading days.The Bank of Japan had been expected to raise interest rates from 0.5% to 0.75% this month, but the weak data and volatile markets changed this and rates were kept at 0.5%.

A brief quote from Greg Weldon (whose technical analysis is available via weldononline.com) regarding the depreciating economics of the world's second largest economy, Japan, is worth noting.

Deflation is taking hold again in Japan ... ... while wealth disinflation is becoming more acute in the US stock market. It is not coincidence that both ... Japanese and US bank shares, brokerage shares, and consumer-retail sector funds are leading the global markets lower. This is a major macro-message being sent to investors around the world. A move in USD-JPY below 118 might just cause the next shoe to drop. Expect it.

The rate of economic growth in the Euro area slowed to 0.3% in the second quarter compared with the previous quarter. This is half the QoQ increases seen for at least the previous 4 quarters, raising some doubts about whether the European Central Bank would soon raise interest rates, although they are still modest.

In the UK, a supermarket price war helped the UK's rate of inflation to fall to 1.9% in July, well below analysts' forecasts. The Consumer Price Index dropped sharply from June's level of 2.4%, raising hopes that further rises in interest rates will not be needed. It is the first time UK inflation has fallen below the government's target of 2% since March 2006. The Retail Price Index, a measure often used in wage bargaining, fell to 3.8% in July from 4.4% the previous month. The impact of the price war demonstrates the power and influence of the major chains and raises the issue of market control. (We have certainly seen the effect in our local town (in Ireland) as the inception of two main stream supermarkets in the past year or so has put three town square convenience stores out of business.)

Trade and FDI

A growing concern I now have is that the US policy will cause the problems in that economy to spread beyond the limit of the current imbalances It appears that they are doing this by trying to restrict trade with China (and others) through media and legal tactics. The problem of safety issues in Chinese goods, from food to toys, obviously needs attention but it has been blown in to a media attack on China that is imbalanced and will have the consequence of reducing the needed flow of lower cost goods from China, thereby reducing consumer choice, increasing inflation and probably reducing consumption too. The other tactic is to litigate through the WTO against IP pirates in China. For similar reasons this will not open China's market to the likes of Microsoft because people in China simply can not afford the full cost of their products. It will also reduce the market share of these brands in China, which will be replaced by lower cost alternatives, in the case of software by open-source versions. And of course there are the complaints about the value of the Yuan. But here again as we have noted before, it is not certain that the currency is so far from equity, it is also destabilising when currencies change too fast. And of course more expensive Yuan, means more expensive imports in the US, which means inflation. If global trade is stifled because the US effectively stops trading with China, then there will a much more severe and unpredictable meltdown of the global financial system.

The US has made a formal request to the World Trade Organization for it to crack down on copyright piracy and counterfeiting in China. It says that China's failure to enforce copyright laws is costing software, music and book publishers billions of dollars in lost sales. The US also argues that China makes it hard for legitimate firms to operate. The two countries have been in talks for four months, since the US first launched its challenge. The US now wants the WTO's Dispute Settlement Body to intervene.

But more revealing is that the US Congress is considering legislation that will implement tariffs on Chinese goods if China does not revalue its currency. There is a high level of rhetoric from both US political parties and presidential candidates, but it is unlikely that the US will actually be able to get such legislation passed into law. Even if such legislation passed Congress (a possibility) it would be vetoed by President Bush. That means that any real change would not be possible until some time in the middle of 2009, by which time the situation will be unpredictably different. And remember that the Yuan has already dropped almost 10% in the last two years since the Chinese started their policy of a crawling peg. The bi-partisan economic illiterates in Congress are effectively advocating lost American jobs and increasing inflationary pressure. Protectionism has a very high cost.

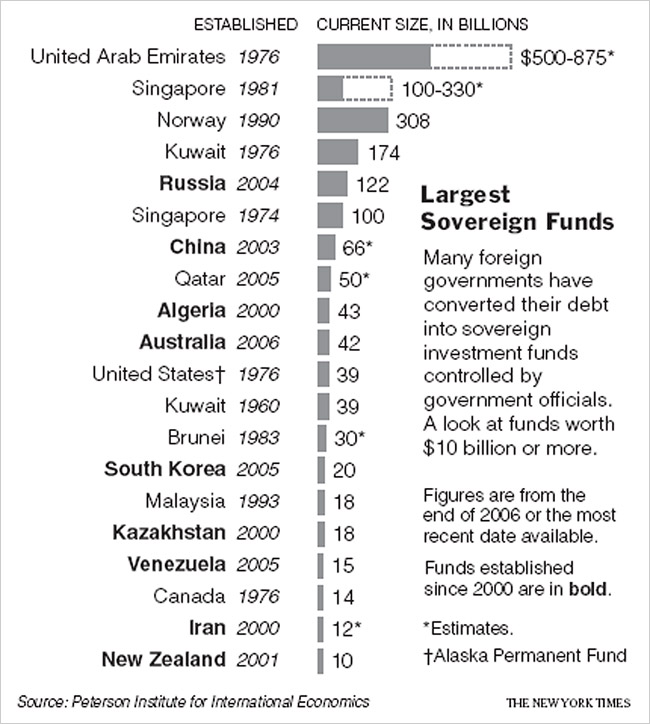

In another protectionist initiative, the Bush administration is pressing the International Monetary Fund and the World Bank to examine the behaviour of sovereign wealth funds, which control up to $2.5 trillion in investments, and develop possible codes of conduct for them. Among the proposed rules would be an obligation to disclose investment methods and to avoid interfering in a host country’s politics. Efforts this year by China and Singapore to buy stakes in Barclays Bank in Britain, and by Qatar to take over Sainsbury’s supermarket chain in Britain, have caused little stir in Britain. Neither Dubai’s bid for Barney’s, the American retailer, nor China’s purchase of nearly a 10% stake in Blackstone this year has produced an outcry in the United States, although there has been some repercussion in China over the recent losses in the Blackstone investment. But in Germany, where there is concern about Russia’s buying up pipelines and energy infrastructure and squeezing Europe for political gain, Chancellor Angela Merkel has warned that purchases by foreign governments or government-controlled companies pose a risk. Probably the most political turbulence caused by a sovereign wealth fund occurred when Temasek Holdings, the state-owned investment branch of Singapore, purchased a stake in the company owned by the prime minister of Thailand, Thaksin Shinawatra. The deal fed antigovernment demonstrations that led to his ouster in a coup in 2006. The worry is that beyond the possibility of foreign funds pushing up prices on bonds, stocks and real estate, they might exercise inappropriate control politically or in the private sphere.

Another twist has occurred in the tale of WTO degeneration. The failure of Doha has been largely because of the unwillingness of rich countries to stop subsidising their industries, particularly commodity industries like cotton. Now the US has found itself in an escalating dispute over internet gambling, which should be open according to WTO agreement, but which the US has prohibited using a virtually unused clause in the treaty. At the end of July Antigua and others which had significant revenues from on-line gambling businesses, launched formal arbitration proceedings to recover lost revenue. Unless the US compensates these jurisdictions, or changes its laws, the message that the WTO is a tool of US convenience will again be reiterated.

Meanwhile CARE, one of the world’s biggest charities, is walking away from some $45 million a year in federal financing, because American food aid is not only plagued with inefficiencies, but also may hurt some of the very poor people it aims to help. CARE’s decision is focused on the practice of selling tons of often heavily subsidized American farm products in African countries that in some cases, it says, compete with the crops of struggling local farmers. The charity says it will phase out its use of the practice by 2009. But it has already deeply divided the world of food aid and has spurred growing criticism of the practice as Congress considers a new farm bill. Under the system, the United States government buys the goods from American agribusinesses, ships them overseas, mostly on American-flagged carriers, and then donates them to the aid groups as an indirect form of financing. The groups sell the products on the market in poor countries and use the money to finance their antipoverty programs. It amounts to about $180 million a year.

The death of the WTO's Doha talks is a primer by the BBC on the WTO and the outlook for global trade. Most will be familiar with the situation, and this is a convenient summary.

In a direct attack against India's right to protect public health, Novartis had challenged an Indian-law that allows the country to refuse a patent for an existing medicine when it is not truly innovative. However, the verdict by an Indian court against the Swiss pharmaceutical company Novartis is an important victory for global public health, according to international aid agency Oxfam and the Interfaith Center on Corporate Responsibility, an institutional investor organization. The decision will protect India's special role as the world's leading provider of affordable medicines to people who depend on inexpensive medicines as their only means of treatment. With this ruling, Novartis and the pharmaceutical industry have been given a clear message to respect developing countries' legal right to use the World Trade Organization TRIPS (trade-related intellectual property) safeguards in order to strike a fair balance between protecting public health and intellectual property, noted Oxfam and ICCR. India, sometimes known as the 'pharmacy of the developing world' due to its massive generic drug production industry, supplies most of the world's affordable generics to developing countries where patented medicines are priced out of most people's reach. More than two-thirds of the generic medicines produced in India are exported to developing countries at a fraction of the cost of patented brand medicines. Multilateral and bilateral aid programs, such as the US AIDS treatment program (PEPFAR), UNICEF and Doctors without Borders, rely heavily on Indian generics.

Activities and Media

August provided a break in the normal routine for us. While our children escaped to visit grandparents with Mum, Dad stayed home to feed the chickens and relive a bachelor lifestyle. What a treat to be woken by the sun instead of the sons! It allowed time to review our web presence and IT, testing the new Fedora distribution (excellent) and preparing the website for a blog. I also set up a bit-torrent client which has been a boon for downloads. The weather was boring with low temperatures and regular showers, but vegetables in the garden continued growing - harvesting tomatoes and French beans started. I love this season when much of our food is fresh from the garden and it just tastes good. As the month drew to an end we had a couple of birthday parties just before returning to the school routine.

Here are a couple of media links. Goodsearch is a search engine which contributes a portion or revenue to a (US) charity of your choice. Why not check it out? This book review of A Billion Bootstraps: Microcredit, Barefoot Banking and the Business Solution for Ending Poverty is a useful smmary in itself. And if you are pursuing or considering micro-finance it might be worth buying the book.

The 11th Hour was released. It is a more visually striking story of our inconvenient truth. To judge from all the gas-guzzlers still fouling the air and the plastic bottles clogging the dumps, it appears that the news that we are killing ourselves and the world with our greed and garbage hasn’t sunk in. This movie is an unnerving, surprisingly affecting documentary about our environmental calamity and is worth viewing. It may not change your life, but it may inspire you to recycle that old slogan-button your folks pinned on their jeans back in the day: If you’re not part of the solution, you’re part of the problem.

We got to see Sicko - definitely Michael Moore-ish. Whether you like him or not, its a stimulating story.

Oxford University philosopher Nick Bostrom and Trinity College bioethicist James Hughes teamed in 2004 to found a forum for a diversity of "voices arguing for a responsible, constructive approach to emerging human enhancement technologies. We believe that technological progress can be a catalyst for positive human development so long as we ensure that technologies are safe and equitably distributed." The Institute for Ethics and Emerging Technologies covers special research areas like Securing the Future, Envisioning the Future, Rights of the Person, and Longer, Better Lives. Essays, white papers, newsletters, discussion forums, and links to projects and events explore a variety of future-oriented issues where technology and society meet, such as the Singularity, human longevity,climate change, and terrorism.

And a quick heads up (given the concern by many about what's happening in teh world of finance) ... The World Investment Prospects to 2011: Foreign Direct Investment and the Challenge of Political Risk is to be released on September 5.

Please forward this publication to associates, family and friends, print

it, and share it.

This is a publication of: Astraea, Ireland + 353 59 9155037 Subscribe

and Unsubscribe

This report has been prepared for information purposes and is not an offer, or an invitation or solicitation to make an offer to buy or sell any securities. This report has not been made with regard to the specific investment objectives, financial situation or the particular needs of any specific persons who may receive this report. It does not purport to be a complete description of the securities, markets or developments or any other material referred to herein. The information on which this report is based, has been obtained from publicly available sources and private sources which may have vested interests in the material referred to herein. Although GRI Equity and the distributors have no specific reasons for believing such information to be false, neither GRI Equity nor the distributors have independently verified such information and no representation or warranty is given that it is up-to-date, accurate and complete. GRI Equity, associates of GRI Equity, the distributors, and/or their affiliates and/or their directors, officers and employees may from time to time have a position in the securities mentioned in this report and may buy or sell securities described or recommended in this report. GRI Equity, associates of GRI Equity, the distributors, and/or their affiliates may provide investment banking services, or other services, for any company and/or affiliates or subsidiaries of such company whose securities are described or recommended in this report. Neither GRI Equity nor the distributors nor any of their affiliates and/or directors, officers and employees shall in any way be responsible or liable for any losses or damages whatsoever which any person may suffer or incur as a result of acting or otherwise relying upon anything stated or inferred in or omitted from this report.